Nomor: SP-10/KO.07/2025

PRESS RELEASE

STABILITY OF EAST JAVA'S FINANCIAL SERVICES SECTOR REMAINS MAINTAINED

Surabaya, July 10, 2025. The economy of East Java as of May 2025 remains stable. According to data from the Central Statistics Agency (BPS) of East Java Province, the economy grew strongly by 5 percent (yoy), with controlled inflation of 1,22 percent (yoy), growing exports, solid fiscal revenues, and robust domestic consumption and investment. This supports economic stability and a positive outlook going forward, despite the weakening global economy and rising geopolitical tensions in the Middle East.

As the supervisor of the financial services sector, the East Java Provincial OJK consistently strives to ensure that all activities in the financial services sector are carried out in an orderly, fair, transparent, and accountable manner. Thus, the stability of the financial services sector is expected to be maintained, enabling it to play a role and contribute optimally to the economy.

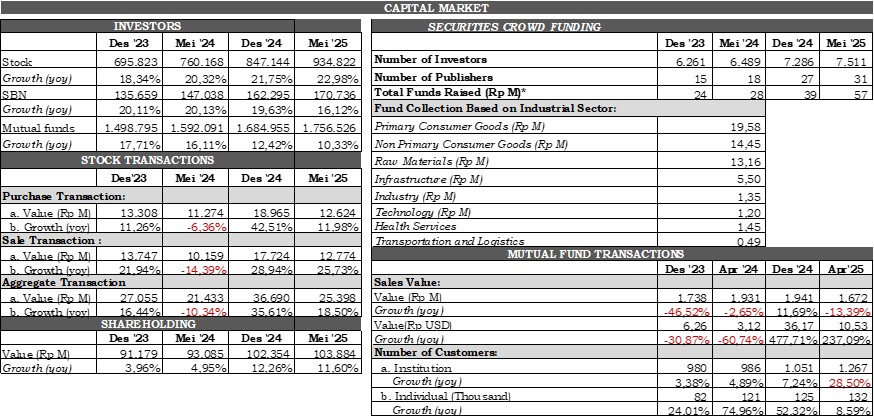

Capital Market Development (PMDK) in East Java as of May 2025

|

|

|

Amid increasing volatility in the financial markets due to several factors such as monetary policy effects, geopolitical uncertainty, changes in interest rates, and the global economy, the number of Single Investor Identifications (SID) for Stocks reached 934.822 SID or grew by 22,98 percent yoy, Government Securities SID rose to 170.736 SID or grew by 16.12 percent yoy, and Mutual Fund SID increased to 1,756,526 SID or grew by 10,33 percent yoy.

As of May 2025, the value of stock transactions in East Java amounted to Rp25.398 trillion, an increase of 18,50 percent compared to the same period the previous year. This reflects continued active stock trading activity despite financial market dynamics. Additionally, stock ownership reached Rp103.884 trillion, up 11,60 percent yoy compared to the same period the previous year, due to a combination of increased investors, stock market strength at the end of 2024, economic stability, and a positive trend in financial literacy. This increase indicates that the capital market remains a trusted main investment alternative for the people of East Java.

In the investment management industry, mutual fund sales until April 2025 reached Rp1.672 trillion, a decrease of -13,39 percent compared to the previous year. This high volatility indicates that investors in East Java are not yet fully stable in choosing mutual funds, possibly due to interest rates, capital market performance, or preferences for other assets such as deposits or stocks. This decline was accompanied by a significant increase in the number of institutional investors by 28,50 percent and individual investors by 8,59 percent. This reflects growing interest from institutional investors in East Java in mutual funds, possibly due to better education, portfolio diversification, and trust in asset management by investment managers, thus boosting portfolio-based investments among institutional investors.

Meanwhile, fundraising through Securities Crowdfunding (SCF), an alternative funding source for UMKM, in East Java as of May 2025 consisted of 31 Issuers, 7.511 investors, and total funds raised amounted to Rp57 billion.

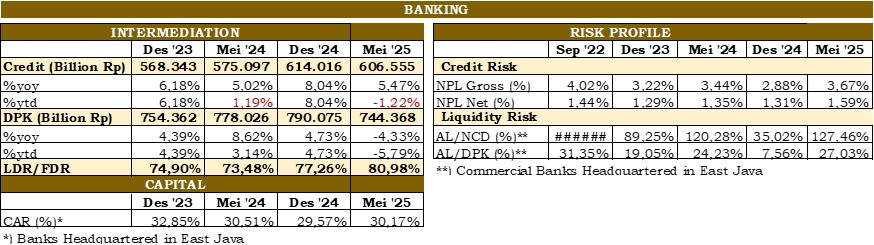

Banking Sector Development (PBKN) in East Java as of May 2025

|

|

|

Bank credit as of May 2025 grew by 5,47 percent yoy to Rp606.555 trillion. Meanwhile, on an annual basis, the growth of Third Party Funds (DPK) declined by -4,33 percent yoy to Rp744.368 trillion due to a shift in public preferences to other investment instruments such as government securities, gold, crypto, stocks, and also fund withdrawals for consumption especially ahead of Eid in May 2025. This resulted in the LDR in East Java being 80,98 percent in May 2025.

Banking industry liquidity in May 2025 remained at an adequate level with well-maintained liquidity ratios. The Liquid Assets to Non-Core Deposit (LA/NCD) and Liquid Assets to DPK (LA/DPK) ratios were 127,46 percent and 27,03 percent respectively, well above the thresholds of 50,00 percent and 10,00 percent. The national Liquidity Coverage Ratio (LCR) stood at 192,41 percent in May 2025. This indicates the banking sector's ability to manage liquidity and meet short-term obligations, allowing for tighter credit risk management, especially for sectors with high default rates. Meanwhile, credit quality remains stable with the net NPL ratio at 1,59 percent and the gross NPL at 3,67 percent. This aligns with ongoing recovery post-high consumption (Ramadan/Eid), notably in UMKM, trade, and industrial sectors in East Java.

Banking resilience also remained strong, reflected in capital adequacy (CAR), supported by retained earnings or capital increases (retained earnings, rights issues, or dividend adjustments) which stood at 30,17 percent, providing a strong buffer amidst global uncertainty.

In terms of development and strengthening in the banking sector, OJK has issued SEOJK Number 2 of 2025 concerning the Minimum Capital Provision Requirement (KPMM) and Minimum Core Capital Fulfillment for Rural Banks (BPR) in alignment with POJK Number 7 of 2024 on BPR and BPRS, POJK Number 1 of 2024 on BPR Asset Quality, and SEOJK Number 21 of 2024 on Banking Accounting Guidelines for BPR.

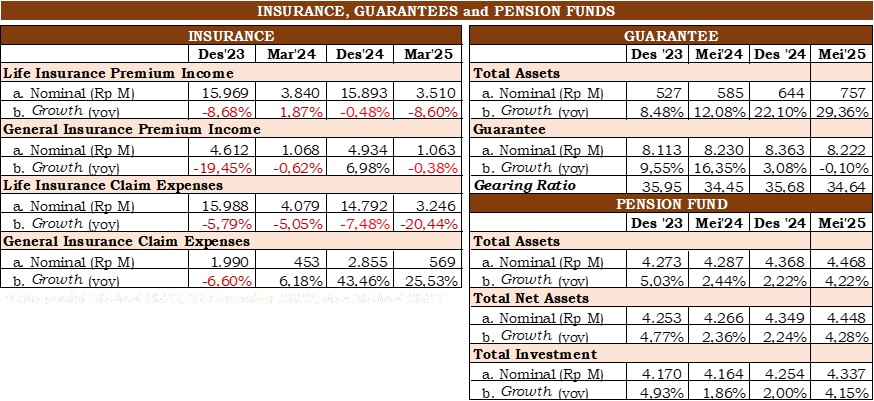

Insurance, Guarantees, and Pension Funds Sector Development (PPDP) in East Java as of May 2025

|

|

|

In the Insurance, Guarantees, and Pension Funds (PPDP) sector, there is a positive trend that supports economic growth and provides better financial protection for the public. The performance of life and general insurance industries recorded significant growth.

As of March 2025, cumulative insurance premium income contracted yoy to Rp3.510 trillion for life insurance and Rp1.063 trillion for general insurance.

In the pension fund industry, total assets as of May 2025 grew by 4,22 percent yoy to Rp4.468 trillion, from Rp4.287 trillion in May 2024. This increase aligns with investment growth of 4,15 percent yoy, with a value of Rp4.337 trillion, compared to Rp4.164 trillion in the same period the previous year. This trend demonstrates the pension fund's ability to manage its investment portfolio optimally, despite global challenges.

In the guarantee sector, the asset value of guarantee companies grew by 29,36 percent yoy to Rp757 billion in May 2025, compared to 12,08 percent (Rp585 billion) in May 2024. However, the guarantee value decreased slightly by -0,10 percent yoy to Rp8.222 trillion compared to Rp8.230 trillion in May 2024.

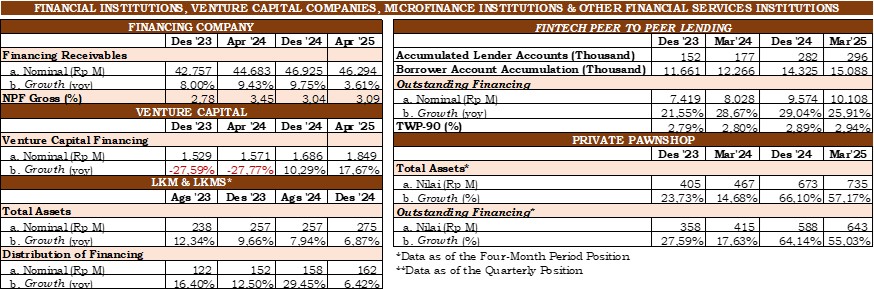

Development of Financing Institutions, Venture Capital, Microfinance Institutions, and Other Financial Service Institutions (PVML) in East Java as of May 2025

|

|

|

In the Financing, Venture Capital, and Microfinance Services (PVML) sector, various indicators showed dynamic trends in April 2025. Financing receivables from Financing Companies (PP) grew by 3,61 percent yoy to Rp46.294 trillion. This growth reflects high demand for financing from both consumer and productive sectors, although consumer purchasing power may be weakened by inflation, rising fuel or electricity tariffs. The sector's risk profile remains healthy with a gross Non-Performing Financing (NPF) ratio of 3,09 percent.

Meanwhile, the venture capital sector showed an increasing trend in April 2025 with financing growth of 17,67 percent yoy, reaching Rp1.849 trillion, up from Rp1.571 trillion in April 2024

In the Fintech Peer-to-Peer (P2P) Lending sector, outstanding financing performance was impressive, increasing by 25,91 percent yoy in March 2025, reaching Rp10.108 trillion, continuing the positive trend from December 2024 (29,04 percent yoy). The bad credit risk rate (TWP-90) was maintained at 2,94 percent yoy, up from 2,80 percent in March 2024.

Meanwhile, total assets of private pawnshops increased significantly, reaching Rp735 billion in March 2025 (57,17 percent yoy), compared to Rp467 billion in March 2024 (14,68 percent). This growth reflects growing public trust in pawnshops as an alternative for quick and easy financing, especially for emergency or microfinance needs. The flexible and community-oriented services of pawnshops, particularly private ones, have shown strong asset growth in 2024 to early 2025, indicating expansion and significant demand. However, attention must be paid to the quality and sustainability of this growth, especially in risk management and profitability.

Consumer Protection Supervision, Financial Literacy, and Consumer Education (PEPK) in East Java as of May 2025

|

|

|

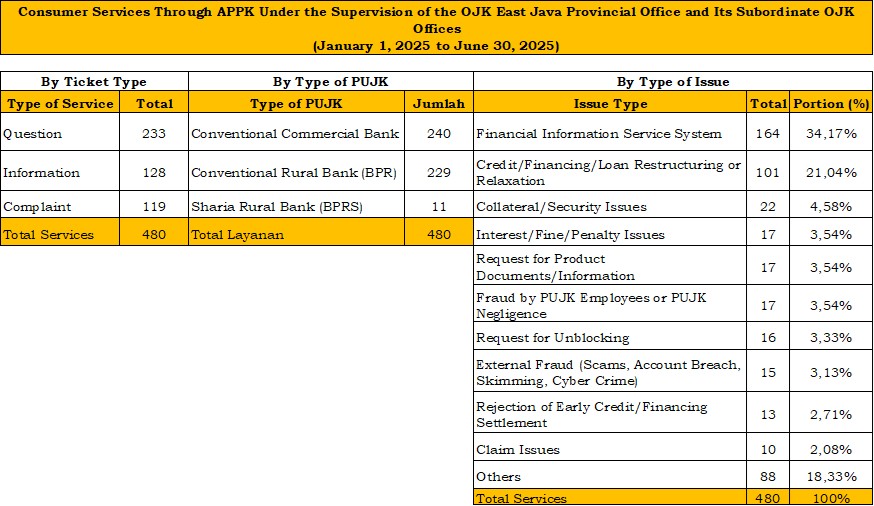

From January 1 to June 30, 2025, based on the Consumer Protection Portal Application (APPK), there were 480 consumer services aimed at Financial Services Business Actors (PUJK) headquartered in the jurisdiction of the OJK East Java Office and its sub-offices. Of this total, 233 were inquiries, 128 were information submissions from consumers, and 119 were complaints. Based on PUJK types, the services included 240 related to Conventional Commercial Banks, 229 related to Conventional BPR Sharia, and 11 related to BPR Sharia. By issue category, the services were mainly related to the Financial Information Services System (SLIK) at 34,17 percent, followed by credit restructuring/relaxation issues at 21,04 percent, collateral/guarantee issues at 4,58 percent, and issues related to interest/penalties/fines, requests for product documents/information, and PUJK employee fraud or negligence, each at 3,54 percent.

To handle consumer protection issues and promote equitable financial literacy and inclusion, OJK continues to promote financial education programs both offline and online, including through its Instagram accounts (@OJK_Jatim; @OJK_Malang; @OJK_Kediri; @OJK_Jember). These social media platforms published 1.235 posts from January to June 2025, with 47.870 followers and 7.592.327 viewers.

Financial Literacy and Inclusion Activities

In collaboration with 38 District/City Financial Access Acceleration Teams (TPAKD) and 1 Provincial TPAKD, OJK in East Java successfully carried out 816 financial education activities reaching 289.590 participants including students, UMKM, farmers, fishers, and women.

To boost financial literacy and inclusion across Indonesia, OJK and the National Council for Financial Inclusion (DNKI) launched the National Smart Finance Movement (GENCARKAN) on August 22, 2024, under the theme “Smart Financial Society Towards Golden Indonesia 2045." In East Java, 2.338 GENCARKAN activities were conducted reaching 505,183 participants between August 2024 and June 2025.

To support the GENCARKAN program, OJK is also accelerating the OJK PEDULI initiative (Financial Literacy Ambassador Movement), and launched Financial Literacy Month (BLK), a national campaign held from May to August 2025, featuring literacy campaigns and financial education series culminating in the Financial Literacy Award.

***

For further information :

Head of the Financial Services Authority (OJK), East Java Province

Phone: (031) 992 10100