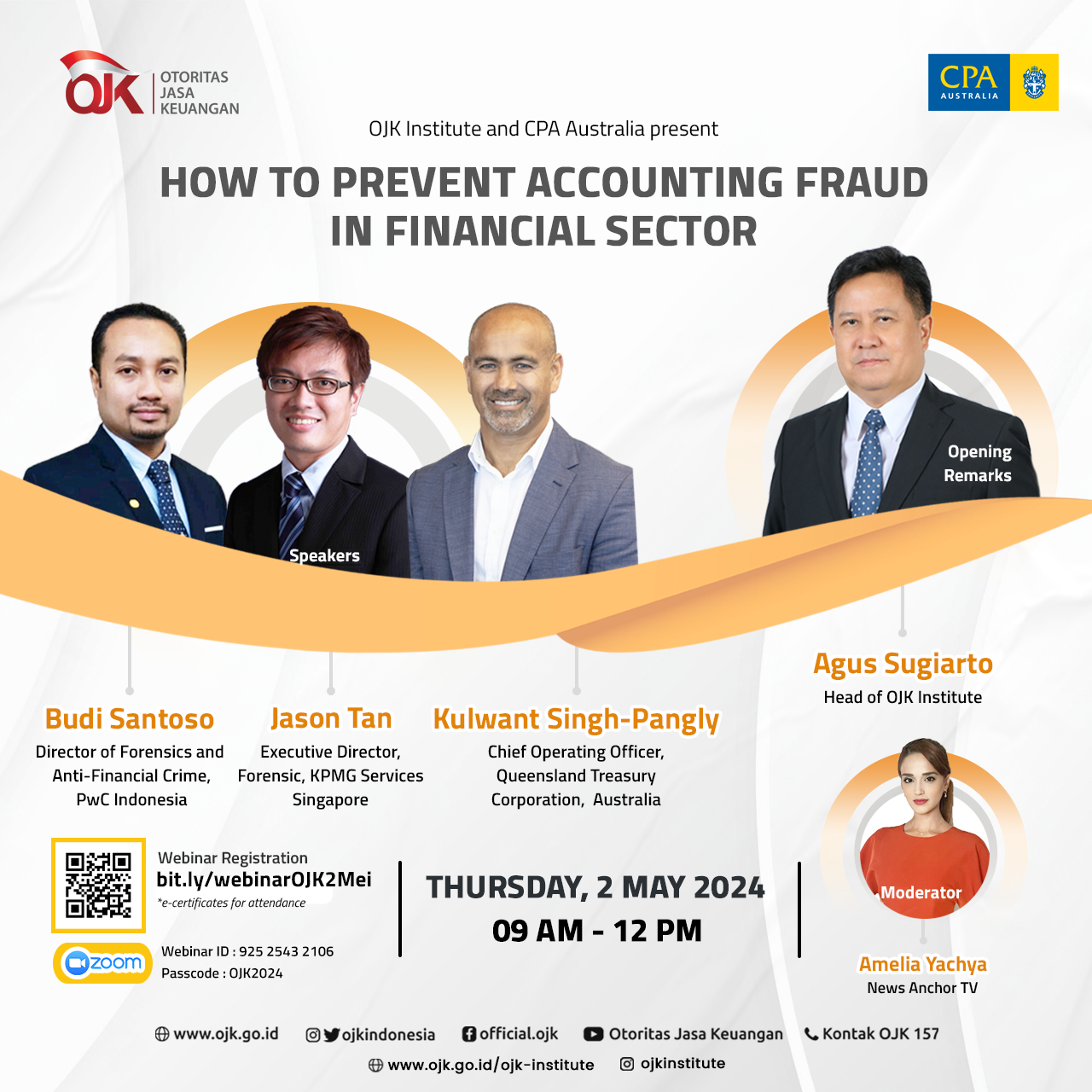

How to Prevent Accounting Fraud in Financial Sector

- 2 Mei 2024

- Lintas Sektor

- Online

Latar belakang

Accounting fraud in the financial sector refers to the manipulation or misrepresentation of financial information with the intent to deceive investors, creditors, or other stakeholders. Such fraudulent activities can have serious consequences for the affected companies, investors, and the overall financial system. Here are some common types of accounting fraud in the financial sector:

- Revenue Recognition Fraud: Inflating sales or recognizing revenue prematurely to make the financial performance appear better than it is.

- Expense Manipulation: Understating expenses to boost reported profits or overstate assets.

- Asset Valuation Fraud: Overstating the value of assets, such as inventory or investments, to inflate the company's financial position.

- Off-Balance-Sheet Financing: Keeping certain liabilities off the balance sheet to portray a healthier financial position than reality.

- Improper Use of Reserves: Manipulating reserves, such as contingency or restructuring reserves, to smooth earnings or create a "cookie jar" for future periods.

- Channel Stuffing: Forcing excessive amounts of products through distribution channels at the end of a reporting period to artificially boost sales.

- Related-Party Transactions: Engaging in transactions with related parties at non-arm's length terms, which can be used to manipulate financial results.

- Inadequate Disclosure: Withholding or providing inadequate information in financial statements, footnotes, or management discussions to mislead stakeholders.

- Fraudulent Financial Reporting: Intentional misrepresentation of financial statements, often involving complex accounting schemes to hide financial problems or create a false impression of financial health.

- Ponzi Schemes: While not exclusive to the financial sector, Ponzi schemes involve using funds from new investors to pay returns to earlier investors, creating a false appearance of profitability.

- Insider Trading: Employees or executives using non-public information for personal gain by trading the company's securities.

Detecting and preventing accounting fraud in the financial sector is crucial for maintaining trust and integrity in the financial markets. Regulatory bodies, auditors, and internal controls play vital roles in identifying and mitigating fraudulent activities. Increased transparency, rigorous auditing procedures, and strong ethical corporate governance practices are essential elements in preventing and addressing accounting fraud in the financial sector. Additionally, whistleblowing mechanisms and a culture of accountability can contribute to early detection and intervention.

Objektif

The primary objective of this webinar is to discuss on how to prevent accounting fraud in the financial sector, therefore it is recommended to focus on three subtopics that address critical aspects of prevention mechanisms, regulatory frameworks, and cultural shifts within organizations.

Peserta

Pembicara

-

Budi Santoso (Director of Forensics and Anti-Financial Crime, PwC Indonesia )

-

Jason Tan (Executive Director, Forensic, KPMG Services Singapore)

-

Kulwant Singh-Pangly (Chief Operating Officer, Queensland Treasury Corporation, Australia)