Research in OJK Institute

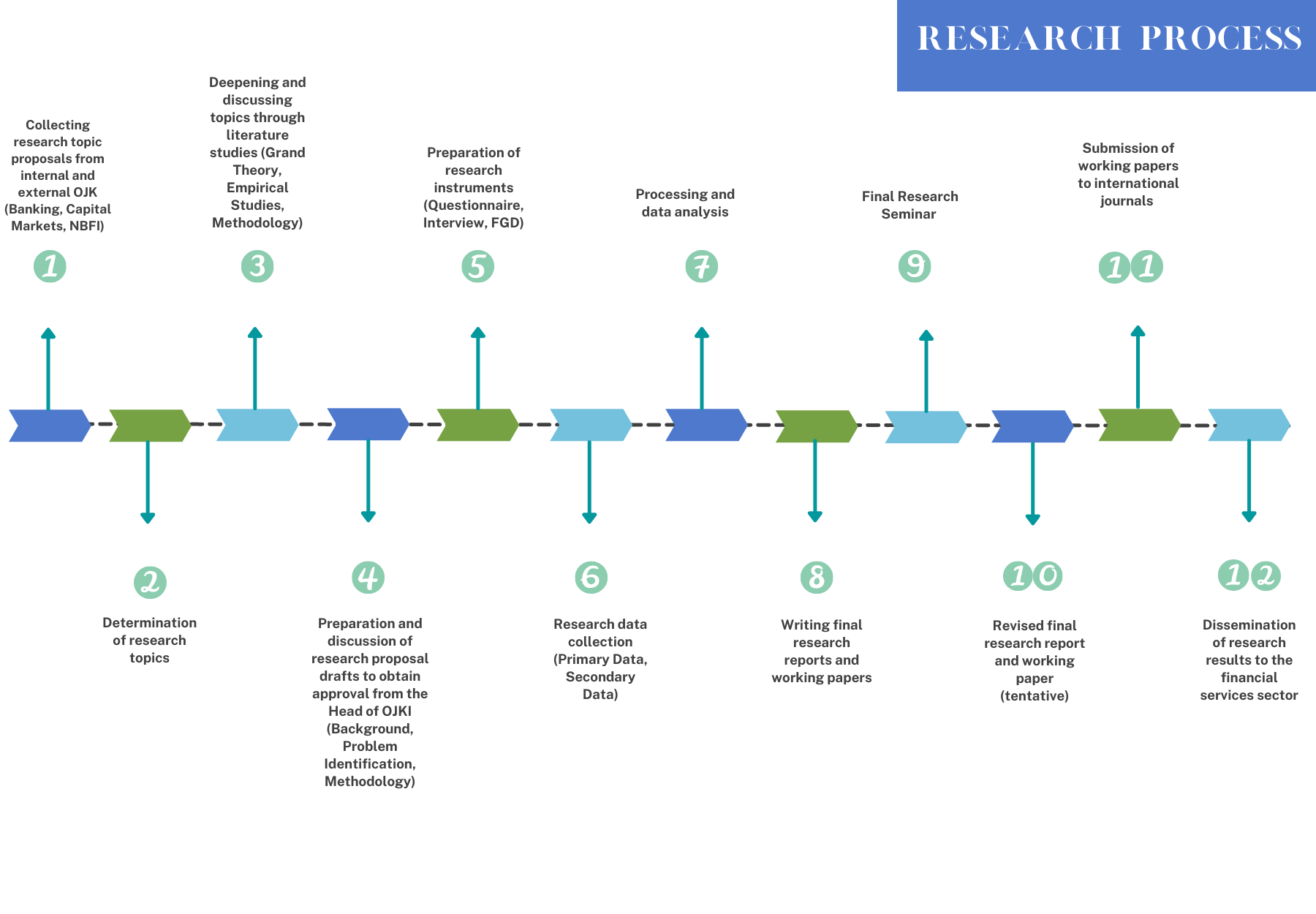

Research at the OJK Institute is academic based, taking into account the latest developments in the financial services sector. The research is structured to produce findings and recommendations that support the performance of the financial services sector.

Tags :

- Riset

- Research

- OJK Institute

- Riset

- Riset

- Research

- OJK Institute

- Riset

OJK Staff Notes Year 2024

Regional Development Banks (BPDs) are expected to play a significant role in the economic development of their respective regions, as outlined in the goals of their establishment detailed in Law No. 13 of 1962 regarding the Basic Provisions of Regional Development Banks. Among the objectives of the establishment of BPDs is to accelerate the implementation of equitable development efforts throughout Indonesia by mobilizing capital and regional potential for financing regional development. As of the latest period in 2023, the loans distributed by BPDs are still predominantly for consumptive purposes and directed to non-SME sectors, despite SMEs being a pillar of the economy that supports 60.5% of the Gross Domestic Product (GDP) with a labor absorption rate of 96.9% of the total national labor absorption.

Regulatory bodies, namely Bank Indonesia (BI) and the Financial Services Authority (OJK), in collaboration with associations, have issued various policies to optimize the performance and role of BPDs in regional economies. These include the BPD Regional Champion (BRC) program launched in 2010 and the BPD Transformation Program introduced in 2015. Despite these efforts, the performance of BPDs appears to be stagnating, and their role in advancing regional economies remains questionable, except for the few larger BPDs (only 4 out of 27 BPDs are classified as KBMI 2, with the remaining 23 classified as KBMI 1). Moreover, in the national banking competition, BPDs' share of credit, total assets, and Third-Party Funds (TPF) is relatively small, accounting for only about 8% of the national banking total. Meanwhile, the number of BPDs constitutes 25.71% of the total number of commercial banks in Indonesia.

This study delves into the competitive landscape of BPDs within the national banking sector through a comparative analysis of various financial ratios, measurement of BPDs' market power using the Lerner Index, and assessment of banking market saturation in regions using the Herfindahl-Hirschman Index. Additionally, the study examines the current regulations on BPDs and regional finances and calculates the projected increase in BPD credit if all BPDs have a minimum core capital of IDR 3 trillion by December 2024, as mandated in POJK Number 12/POJK.03/2020 regarding Commercial Bank Consolidation.

The findings of this study include that BPDs have not maximized their role in the development of regional economies, thereby failing to become regional champions in their respective areas. The Non-Performing Loan (NPL) rate for productive loans (KMK) is higher than that for consumptive loans, even though the volume of productive loans exceeds that of consumptive loans. Moreover, the majority of provinces with BPDs having core capital < IDR 3 trillion exhibit low or unconsolidated banking market concentration, indicating a competitive banking market with ample room for BPDs to expand their businesses.

Link: https://drive.google.com/drive/folders/11lz0ktlMv4EH5-HNADOuXwPn1ob_2XSm

OJK Staff Notes Tahun 2023

Climate change poses a significant global challenge, necessitating urgent and coordinated action to mitigate its impacts (IPCC, 2018). In response, the carbon market and the widespread adoption of electric vehicles (EVs) have emerged as crucial solutions in the global efforts to combat climate change and transition to a low-carbon economy. However, the successful implementation of these solutions relies heavily on the active participation of the financial sector.

The financial sector, with its expertise in capital mobilization, risk management, and innovative financial products, is uniquely positioned to drive the development of the carbon market and support the transition to EVs (Loche et. al, 2019; GFMA & BCG, 2020). Through its involvement, the financial sector can play a transformative role in redirecting investments towards sustainable initiatives and facilitating the necessary infrastructure and financing mechanisms to accelerate the adoption of low-carbon technologies.

The carbon market, encompassing carbon pricing mechanisms and carbon offset trading, aims to put a price on carbon emissions, incentivizing businesses to reduce their greenhouse gas (GHG) emissions (World Bank, 2019). The financial sector's knowledge and experience in financial modeling, risk assessment, and market oversight are instrumental in designing and managing effective carbon pricing mechanisms such as carbon taxes and cap-and-trade systems. These mechanisms create economic incentives for emission reductions and promote a more sustainable and efficient use of resources.

In addition to carbon pricing, the financial sector plays a vital role in the creation and trading of carbon offsets. Financial institutions invest in emission reduction projects and support initiatives such as renewable energy, forestry, and energy efficiency, generating offsets that can be bought and sold in the carbon market. These investments contribute to the development of sustainable projects, encourage emission reductions beyond regulatory requirements, and enable companies to offset their own emissions.

Furthermore, the financial sector enhances the liquidity and efficiency of the carbon market by providing trading platforms, market-making activities, and derivatives instruments (Carbon Pricing Leadership Coalition, n.d.). This involvement facilitates price discovery, improves market transparency, and enables effective risk management. Financial institutions also develop carbon risk hedging products, allowing companies to manage price volatility and plan for long-term carbon liabilities, thereby fostering stability and confidence within the carbon market.

In the realm of electric vehicles, the financial sector plays a critical role in financing the necessary infrastructure. This includes supporting the deployment of charging stations, battery manufacturing facilities, and research and development initiatives. Through project financing, venture capital investments, and public-private partnerships, financial institutions contribute to the expansion of the EV charging network, addressing one of the primary barriers to widespread EV adoption—range anxiety and inadequate infrastructure.

Moreover, financial institutions offer consumer financing options and leasing agreements that make EVs more affordable and accessible to individuals and businesses (Mohan & Gupta, 2019). By providing competitive interest rates, flexible repayment terms, and tailored financing solutions, they encourage a broader consumer base to transition from traditional combustion engine vehicles to EVs. This financial support significantly drives market demand and facilitates the mass adoption of electric vehicles.

| Future of Finance : DECENTRALIZED FINANCE (De-Fi): Peluang, Tantangan dan Risikonya | https://bit.ly/staffnotesOKTOBER2023 |

| It Takes More Than Two to Tango: Banks’ NIM, CIR, Costs and Profitability | https://bit.ly/staffnotesJUNI2023 |

OJK Institute Research Year 2022

Researchers:

Saut Simanjuntak - Otoritas Jasa Keuangan, Jakarta, Indonesia

Rosnita Wirdiyanti - Otoritas Jasa Keuangan, Jakarta, Indonesia

Muhammad Algifari - Otoritas Jasa Keuangan, Jakarta, Indonesia

Abstract

This study evaluates the behavior of Microfinance Institutions (MFIs) towards technology-based microfinance systems. Through a survey of 1371 MFIs from 33 provinces in Indonesia, we used the SEM-PLS approach to estimate the intention to continue using technology adoption to observe MFI behavior towards technology-based microfinance systems. The results indicate that the overall performance of the MFIs and financial capability as a proxy for MFI satisfaction are two strong predictors for continuing technology goals. Overall, our findings suggest that government support in facilitating the development of the digital microfinance ecosystem encourages a significant shift of microfinance transactions to digital platforms. Ultimately, this results in higher satisfaction for MFIs due to the realization of perceived benefits and enhances MFIs' continued adoption of technology.

Researchers:

Noer Azam Achsani - School of Business IPB University (SB - IPB), Bogor, Indonesia

Linda Karlina Sari - School of Business IPB University (SB - IPB), Bogor, Indonesia

Ade Holis - School of Business IPB University (SB - IPB), Bogor, Indonesia

Bayu Bandono - OJK Institute, Indonesia Financial Services Authority (OJK), Jakarta, Indonesia

Gandhi Cahyo Wicaksono - OJK Institute, Indonesia Financial Services Authority (OJK), Jakarta, Indonesia

Abstract

This paper shows evidence of a dramatic change in the structure and time-varying patterns of volatility connectedness between Indonesian and global stock market volatility during the COVID-19 outbreak. The analysis uses the Diebold-Yilmaz volatility spillover to capture volatility spillover index. This research used secondary data in October 2018-March 2021 resourced from Indonesia Stock Exchange (IDX) and Bloomberg. The dynamic total connectedness across the stock market, which was moderate and relatively stable until early 2020. After that, the real connectedness spikes, and the direction of connectedness alters, which concurs with the COVID-19 outbreak. DJIA and EURO indices were the primary transmitters of shocks before the outbreak, whereas JKSE became the primary shock transmitters during the COVID-19 outbreak. Even though JKSE was a robust transmitter during the COVID-19 outbreak, the connection with DJIA must be watched out for because of the very high spillover. The COVID-19 episode had immediate and unsettling impacts, which is essential for formulating policies to achieve financial stability. The findings also point to a potential threat to investor portfolios and a potential fading of the advantages of diversification. This paper would complement the emerging body of existing literature by examining how Indonesia stock market connected with global market. Furthermore, this is the first investigation capturing volatility spillover between Indonesia market and global market by using Diebold-Yilmaz approach during the COVID-19 outbreak.

Researchers:

Wahyoe Soedarmono - Sampoerna University, Faculty of Business, Jakarta, Indonesia

Siti Yayuningsih - Otoritas Jasa Keuangan, Jakarta, Indonesia

Inka Yusgiantoro - Otoritas Jasa Keuangan, Jakarta, Indonesia

Abstract

This paper contributes to the insurance literature that remains widely unexplored. Our contribution is twofold. First, we assess whether life insurance and general insurance firms in the Islamic (sharia) insurance market perform differently in terms of profitability and market share. In this regard, to our knowledge, this paper is the first to compare the performance of sharia life insurance and sharia general insurance. Second, we assess whether the link between sharia insurance and performance measures is also affected by firms-specific factors, such as capital ratio, leverage, overhead cost, solvency and size of total assets.

Researchers:

Mulia Simatupang - Otoritas Jasa Keuangan, Jakarta, Indonesia

Inka Yusgiantoro - Otoritas Jasa Keuangan, Jakarta, Indonesia

Rosnita Wirdiyanti - Otoritas Jasa Keuangan, Jakarta, Indonesia

Hanif Ashar - Otoritas Jasa Keuangan, Jakarta, Indonesia

Abstract

This paper investigates the determinants of corporate loan default using Otoritas Jasa Keuangan Financial Information Services System (SLIK) database. We find that borrower characteristic is significant predictor for corporate loan default especially associated with public ownership (listed company) and business size (MSMEs or large company). Loan characteristic is also significant predictor for corporate loan default especially loan associated with government program and compatibility of loan project / purpose with borrower business expertise. Furthermore, COVID-19 pandemic period has significant impact to increase corporate loan default. Meanwhile, government loan restructuring is decreasing corporate loan default during COVID-19 period and it confirms the effectiveness of policy.

Researchers:

Endang Nuryadin - Otoritas Jasa Keuangan, Jakarta, Indonesia

Sulistyoningsih - Otoritas Jasa Keuangan, Jakarta, Indonesia

Abstract

The principle of benefit (maslahah) makes Islamic banks not only as institutions that pursue corporate profits alone (commercial / profit-oriented), but also must meet the benefits for many parties (social-benefit oriented). Islamic banks in carrying out their social functions can contribute significantly in supporting the national economy and improving people's welfare. However, despite its positive contribution, the implementation of social functions of Islamic banks is also inseparable from the risks embedded in it.

Therefore, this study aims to determine the effect of the Islamic bank social function performance on its commercial function performance in Indonesia, particularly on the risk management and profitability. This study also seeks to build an index that can be used as a performance measurement tool for the social functions of Islamic banks in Indonesia. Using estimation methods of common effect and fixed effect on a panel data of 9 full-fledged Islamic banks (BUS) and 20 Islamic commercial bank windows (UUS), this study verified that the performance of social function significantly affected the performance of commercial function of Islamic banks in Indonesia.

The performance of social functions has a positive and significant effect on ROA and a negative and significant effect on NPF of Islamic banks at the industry level as a whole. The implementation of the social function also significantly increases the ROA of UUS, although it does not necessarily reduce the NPF significantly. Conversely, an increase in the performance of social functions can significantly reduce the level of financing risks of a full-fledged Islamic bank (BUS), although it does not significantly affect its profitability. These findings conformed that the implementation of social functions of Islamic banks does not interfere with their commercial performance. It is hoped that this finding will encourage Islamic banks in Indonesia to optimize the implementation of their social functions.

Researchers:

Edi Setijawan - Otoritas Jasa Keuangan, Jakarta, Indonesia

Sulistyoningsih - Otoritas Jasa Keuangan, Jakarta, Indonesia

Abstract

In Islamic economics and finance, any commercial entity should implement social function. This includes Islamic banks which have been in operation in Indonesia for the past three decades. However, social function implementation was not fully integrated in the Islamic bank’s soundness level assessment. This fact has caused unoptimized Islamic social fund potential. This paper attempts to identify determinants of Islamic bank social function, to develop an index of Islamic banking social function, and to integrate social function into Islamic bank soundness level assessment. Principal Component Analysis (PCA) and Analytic Network Process (ANP) were used to identify indicators of Islamic bank social function. Analytic Hierarchy Process (AHP) was employed to conduct weighting process for indicators of Islamic bank social function. AHP is also used to do the weighting for all variables in the new proposal of Islamic bank soundness level. The study found that there are 11 indicators of social function of Islamic bank. Integration of social function into the new soundness assessment was done through inclusion of social function as the fifth variable of Islamic bank soundness level, in addition to Islamic bank’s risk profile, GCG, rentability and capital. A new formula to assess Islamic bank soundness level was introduced as the result.

Researchers:

Saut Simanjuntak - Otoritas Jasa Keuangan, Jakarta, Indonesia

Rosnita Wirdiyanti - Otoritas Jasa Keuangan, Jakarta, Indonesia

Milan Malinda Mardiyyah - Otoritas Jasa Keuangan, Jakarta, Indonesia

Abstract

This research examines the sustainability intention to adopt digital finance by micro and small enterprises (MSEs) in Indonesia. Utilizing survey data from 7,301 MSEs that have used digital finance technologies across 33 provinces in Indonesia, this study employs SEM-PLS to empirically identify the determinants of MSEs' sustainability intention in adopting digital finance. The research finds that the variables of satisfaction, perceived usefulness, and attitude towards technology have a significantly positive impact on sustainability intention. Furthermore, the variable perceived risk negatively affects sustainability intention through its impact on perceived usefulness and attitude towards technology. Meanwhile, the perceived ease of use variable has the strongest influence on sustainability intention, through perceived usefulness. Finally, significant internal and external environmental aspects are system support and self-efficacy.

Researchers:

Noer Azam Achsani - School of Business IPB University (SB - IPB), Bogor, Indonesia

Linda Karlina Sari - School of Business IPB University (SB - IPB), Bogor, Indonesia

Ade Holis - School of Business IPB University (SB - IPB), Bogor, Indonesia

Darul Dimasqy Kramawiredja - OJK Institute, Otoritas Jasa Keuangan, Jakarta, Indonesia

Ivan Guruh Setyawan - OJK Institute, Otoritas Jasa Keuangan, Jakarta, Indonesia

Abstract

The purpose of this paper is to investigate the factors affect the profitability of pension fund companies in Indonesia before and after Covid-19. This paper analyzes the relationship between portfolio investment, specific company characteristics, macroeconomics indicators, and pension fund profitability in the period 2013 - 2021. The study used 151 individual data of pension fund companies in Indonesia from 2013 to 2021. Panel data analysis used to analyze the impact of portfolio investment, specific company characteristics, macroeconomics indicators, and Covid-19 Outbreak on the profitability of financial institutions. The robust results reveal that the pension fund profitability in Indonesia is explained by the proportion of stock owned by the company, the operating cost ratio, and the ratio of accounts receivable to net assets. The higher the proportion of stock owned by company, the higher the company's profitability. On the other hand, the operating cost ratio and the ratio of accounts receivable to net assets are found to be negatively and significantly related to the company's profitability. Furthermore, this study found that the Covid-19 Outbreak did not have a significant impact on the profitability of pension fund companies. This study is the first to compare the determinants of pension fund profitability during the Covid-19 Outbreak. This study used population data of individual pension fund institution in the period 2013 - 2021.

Researchers:

Agus Sugiarto - OJK Institute, Otoritas Jasa Keuangan, Jakarta, Indonesia

Ni Nyoman Puspani - OJK Institute, Otoritas Jasa Keuangan, Jakarta, Indonesia

Fara Fathia - OJK Institute, Otoritas Jasa Keuangan, Jakarta, Indonesia

Abstract

Increased numbers of policy tools related to sustainable finance has encourage investors to consider the factor of environmental, social, and governance (ESG) in their investment decisions, which has also became one of the main drivers of the recent surge of assets under management (AUM) of global and Indonesian ESGs. This study analyzes the influence of ESG factors on the performance of stocks by using fixed effect model as well as analyzing the perception of investor to ESG as an indicator to determine investment by using the survey method. The results of the study show that the ESG value has a positive influence on the stock performance which was proxied by the value of the market capitalization. Of the three ESG factors, only social factors that have a positive and significant influence on stock performance. Based on the survey results, individual and institusional investors in Indonesia already have a good understanding of ESG; have high interest in ESG; and has allocated their investment towards ESG stocks. In addition, the factor that investors are considered the most in their investment decisions are carbon emissions and waste management in environmental factors; social impact on social factors; and reputation on the governance factors.

This paper has been published at the International Journal of Energy Economics and Policy

Researchers:

Agus Sugiarto - OJK Institute, Otoritas Jasa Keuangan, Jakarta, Indonesia

Ni Nyoman Puspani - OJK Institute, Otoritas Jasa Keuangan, Jakarta, Indonesia

Mustika Septiyas Trisilia - OJK Institute, Otoritas Jasa Keuangan, Jakarta, Indonesia

Abstract

Climate change poses new challenges to the banking sector. Thus, in this paper, we investigate the effect of climate change on bank loans using panel data covering 7,865 banks in Indonesia from 2011-2021. We define bank loans into three variables, i.e., outstanding credit, non-performing loans (NPLs), and interest rates. Our results suggest that, of the six climate-related disasters, the flood has a significant and consistent effect. An increase in the frequency of floods reduces credit and increases NPLs. Consistent results are found for disaster risk index scores. The empirical results show that there is a negative effect of climate change on bank loans so further policies from banks and regulators' side are needed.

This paper has been published at the International Journal of Energy Economics and Policy

OJK Institute's Research 2021

Sejak terjadi pandemi covid 19 di tahun 2020, lebih dari jutaan orang di dunia terinfeksi virus covid 19 dan berdampak luas pada krisis kesehatan dan ekonomi global. Banyak negara yang melakukan pembatasan aktivitas social dan berakibat kepada melambatnya laju perekonomian di hampir sebagian besar negara di dunia seperti Amerika Serikat, Uni Eropa, Tiongkok, Jepang dan Korea Selatan. Laporan dari Global Economic Prospect (2021) menunjukkan bahwa, pertumbuhan ekonomi mengalami kontraksi sebesar 4,3% pada tahun 2020 secara global. Dampak dari penyebaran Covid-19 ini juga dirasakan oleh Indonesia yang mengalami resesi pada kuartal III tahun 2020 sebesar -3,49%. Hal ini tentunya berpengaruh langsung pada Industri Jasa Keuangan (IJK) baik pada sektor Perbankan, Pasar Modal dan Industri Keuangan Non Bank (IKNB).

Researchers: OJK Institute Research Team

(*) Currently this research paper only available in Bahasa Indonesia

Setelah wabah Covid-19 meluas ke berbagai negara, pergerakan bursa global secara signifikan menunjukkan tren negatif. Indeks Harga Saham Gabungan (IHSG) Indonesia menjadi salah satu bursa yang tertekan sangat besar sejak awal tahun 2020. IHSG mulai bergerak di bawah level 6.000 sejak 31 Januari 2020 dan mencapai titik terendah sebesar 3.937 pada 24 Maret 2020 yang terjadi di seluruh indeks sektoral. Hal ini terjadi setelah pemerintah Indonesia mengumumkan munculnya virus Covid-19 di Indonesia. Penurunan ini tentunya tidak lepas dari sentimen negatif investor dalam menilai keseriusan pemerintah Indonesia untuk menangani pandemi dan para investor lebih memilih untuk menarik dananya dari pasar modal yang mengakibatkan terjadi penurunan harga saham. Untuk memahami dampak jangka pendek Covid-19 terhadap shareholder return, dibutuhkan penelitian yang menganalisis pengaruh pengumuman resmi Covid-19 di berbagai sektor saham Bursa Efek Indonesia (BEI) secara lebih mendalam serta menganalisis bagaimana pengaruh sentimen investor yang tercermin dalam volatilitas saham dan Covid-19 terhadap shareholder return pada setiap sektor saham di BEI.rsa global secara signifikan menunjukkan tren negatif. Indeks Harga Saham Gabungan (IHSG) Indonesia menjadi salah satu bursa yang tertekan sangat besar sejak awal tahun 2020. IHSG mulai bergerak di bawah level 6.000 sejak 31 Januari 2020 dan mencapai titik terendah sebesar 3.937 pada 24 Maret 2020 yang terjadi di seluruh indeks sektoral. Hal ini terjadi setelah pemerintah Indonesia mengumumkan munculnya virus Covid-19 di Indonesia. Penurunan ini tentunya tidak lepas dari sentimen negatif investor dalam menilai keseriusan pemerintah Indonesia untuk menangani pandemi dan para investor lebih memilih untuk menarik dananya dari pasar modal yang mengakibatkan terjadi penurunan harga saham. Untuk memahami dampak jangka pendek Covid-19 terhadap shareholder return, dibutuhkan penelitian yang menganalisis pengaruh pengumuman resmi Covid-19 di berbagai sektor saham Bursa Efek Indonesia (BEI) secara lebih mendalam serta menganalisis bagaimana pengaruh sentimen investor yang tercermin dalam volatilitas saham dan Covid-19 terhadap shareholder return pada setiap sektor saham di BEI.

Researchers: OJK Institute Research Team

(*) Currently this research paper only available in Bahasa Indonesia

Kredit perbankan mengalami penurunan selama masa pandemi Covid-19. Pemintaan akan sumber dana yang menurun ditunjukkan oleh penurunan realisasi jumlah kredit yang disalurkan ke sektor dunia usaha dan rumah tangga. Pada bulan keempat tahun 2020, pertumbuhan kredit sebesar 5,82%, menurun sebesar 2,24% (yoy) dari bulan sebelumnya. Pertumbuhan kredit juga menurun dibandingkan bulan April tahun sebelumnya sebesar 11,12 persen. Selama tahun 2020, pertumbuhan kredit terus mengalami penurunan hingga bulan Januari tahun 2021 menjadi minus 1,90 persen. Bersamaan dengan hal tersebut, suku bunga 7 day repo rate Bank Indonesia (suku bunga acuan BI) mengalami penurunan sebesar 125 bps. Penurunan suku bunga seharusnya diikuti dengan peningkatan jumlah kredit karena masyarakat dapat meminjam uang dengan harga lebih murah. Namun turunnya suku bunga acuan BI tidak di barengi dengan meningkatnya permintaan kredit, atau terjadi anomali. Perbankan nampak sangat berhati- hati untuk menyalurkan kredit kepada masyarakat karena adanya risiko peningkatan Non Performing Loan (NPL) perbankan. Keadaan penurunan kredit tersebut dapat mengindikasikan bahwa telah terjadi credit crunch di Indonesia, yaitu suatu kondisi dimana bank enggan untuk menyalurkan kredit yang dapat disebabkan oleh perkiraan meningkatnya risiko kredit di masa depan dan berkurangnya modal bank dari jumlah ideal. Oleh karena itu, penelitian mengenai apakah terjadi fenomena credit crunch dan faktor- faktor yang mempengaruhinya selama pandemi Covid-19 di Indonesia ini penting dan relevan bagi pertumbuhan sektor jasa keuangan, khususnya sektor perbankan.

Researchers: OJK Institute Research Team

(*) Currently this research paper only available in Bahasa Indonesia

Keberadaan financial technology (fintech) menjadi jawaban kebutuhan masyarakat akan adanya sumber pendanaan yang murah dan mudah khususnya bagi masyarakat yang unbankable. Sebagai alternatif pembiayaan, fintech lending memiliki potensi untuk mengisi ceruk kebutuhan dana yang masih besar yang selama ini tidak terjangkau oleh bank konvensional sehingga dapat membantu mendorong inklusi keuangan di Indonesia. Hal ini menjadikan fintech lending mengalami pertumbuhan yang cukup pesat selama pandemi. Merujuk pada Indonesia Fintech Report 2020 yang dirilis oleh Fintechnews Singapore, layanan pembiayaan digital (fintech lending) paling dominan di Indonesia dengan pangsa sebesar 50% pada tahun 2020. Lebih lanjut, akses Usaha Mikro, Kecil dan Menengah (UMKM) terhadap kredit atau pembiayaan perbankan masih sangat terbatas, hal ini terlihat dari penggunaan produk Kredit Usaha Rakyat (KUR), KUR Syariah, kredit/pembiayaan mikro, dan pembiayaan mikro syariah tahun 2019 yang masing-masing hanya 3,55%, 0,26%, 0,27%, dan 0,03%. Hal ini disebabkan UMKM pada umumnya berkategori unbankable atau belum memenuhi persyaratan untuk memperoleh pembiayaan perbankan. Kehadiran fintech yang mengusung teknologi digital diharapkan mampu menerobos kesulitan tersebut, namun demikian perusahaaan fintech diduga belum melaksanakan strategi pemasaran yang benar khususnya penerapan bauran pemasaran 8P sehingga tidak sedikit masyarakat yang belum meyakini produk fintech mengingat terdapat banyak kasus pinjaman online ilegal. Maka dari itu, untuk meningkatkan value proposition dalam rangka meningkatkan pemasaran fintech di UMKM, diperlukan strategi product, place, price, promotion, process, people, dan physical evidence. peran fintech lending perlu dioptimalkan agar dapat mendorong inklusi keuangan terutama untuk sektor UMKM yang unbankable. Maka dari itu, penelitian terkait fintech lending dan inklusi keuangan pada UMKM menjadi hal yang penting dan relevan untuk dilakukan guna menganalisis dampak fintech lending bagi UMKM sehingga dapat meningkatkan inklusi keuangan yang berkelanjutan.

Researchers: Sukarela Batunanggar, Widyo Gunadi, Nika Pranata, Billy Saputra

The demand for digital talent is increasing while its supply is limited, leading to a gap in the financial services sector, both in quantity and quality. This research identifies problems faced in fulfilling the needs and strategies for developing digital talent at the FSS. It uses a mixed-method (quantitative and qualitative) through systems thinking approach, ease benefit matrix, and paired comparison. The research held 11 Focus Group Discussions (FGD) with any speakers from various stakeholders to determine the problems and possible solutions. Furthermore, it also surveyed 73 respondents from banking leaders that underwent a digital transformation. This research formulated 18 (eighteen) proposals for a comprehensive digital talent development strategy in the financial services sector and a roadmap.

| Paper published in: Journal of Management Information and Decision Sciences |

Researchers: Sukarela Batunanggar, Ni Nyoman Puspani, Fara Fathia

(*) Currently this research paper only available in Bahasa Indonesia

Ketika permasalahan industri jasa keuangan berupa rendahnya inklusi inklusi dan literasi keuangan, kesenjangan pembiayaan UMKM, dan kemiskinan belum kunjung selesai, Indonesia kini menghadapi tantangan baru di era Revolusi Industri 4.0. Disrupsi digital menjadi driver terhadap transformasi bisnis di sektor jasa keuangan baik dari sisi market, organisasi, kepegawaian, kepemimpinan, serta dari sisi sosial dan lingkungan hidup. Dalam menghadapi hal-hal tersebut diperlukan pemimpin yang memiliki visi transformatif dan kapasitas internal yang berkualitas sebagai posisi strategis dalam pengambilan keputusan. Berdasarkan permasalahan tersebut, maka riset ini bertujuan untuk menyusun model, rekomendasi kebijakan dan strategi pengembangan Holistic Leadership (HL) yang diharapkan menjadi salah satu faktor untuk mendorong tercapainya sustainable finance dalam rangka menyelaraskan antara kepentingan ekonomi, sosial, dan lingkungan hidup. Adapun pendekatan yang digunakan dalam riset ini adalah mixed method (kuantitatif dan kualitatif) melalui pendekatan berpikir sistem (systems thinking), tinjauan literatur, analisis benchmarking, ease benefit matrix, dan paired comparison. Dalam mendalami permasalahan dan menggali masukan, riset ini juga mengadakan 11 kali focus group discussion (FGD) dengan 17 narasumber dari berbagai pemangku kepentingan. Selain itu, riset ini juga melakukan survey kepada 64 responden dari pimpinan perbankan yang sudah melakukan transformasi digital. Secara kualitatif, riset ini merumuskan model HL serta 14 usulan strategi pengembangannya pada sektor jasa keuangan yang komprehensif. Secara kuantitatif, diperoleh tiga usulan strategi yang menjadi prioritas yaitu: (1) Personal leadership development plan, (2) Coaching, training, dan mentoring, (3) Skema pertukaran pegawai dan pemimpin untuk memperkaya pengalaman.

Paper published in: Jurnal Academic of Strategic Management Journal, inpress volume 20 special issue 3 2021

Researchers: Sukarela Batunanggar, Baruna Hadibrata, Fadhila Zahra Humaira, Bonardo

(*) Currently this research paper only available in Bahasa Indonesia

Dalam era Revolusi Industri 4.0 dan perkembangan teknologi digital yang sangat pesat ini, financial technology (fintech) yang awalnya merupakan pemain baru telah berubah posisi menjadi pemain penting pada sektor jasa keuangan. Akan tetapi, permasalahan sosial Indonesia seperti kemiskinan yang berpengaruh pada rendahnya inklusi dan literasi keuangan, serta kesenjangan pembiayaan UMKM belum kunjung selesai. Sehingga dibutuhkan suatu pendekatan inovatif yang dapat mengatasi isu sosial (khususnya kemiskinan) di Indonesia dengan memanfaatkan teknologi finansial bernama social fintech. Berdasarkan hal tersebut, perlu dilakukan inisiatif yang mendukung berkembangnya social fintech di Indonesia. Sehingga riset ini bertujuan untuk memetakan tipe-tipe social fintech yang ada di Indonesia serta merumuskan strategi pengembangan social fintech di Indonesia. Adapun pendekatan yang digunakan dalam riset ini adalah mixed method (kuantitatif dan kualitatif) melalui pendekatan berpikir sistem (systems thinking), tinjauan literatur, analisis benchmarking, ease benefit matrix, dan paired comparison. Dalam mendalami permasalahan dan menggali masukan, riset ini juga mengadakan 6 kali Focus Group Discussion (FGD) dengan 16 narasumber dari berbagai pemangku kepentingan. Selain itu, riset ini juga melakukan survey kepada 42 responden dari pelaku social fintech. Secara kualitatif, riset ini memetakan 3 (tiga) tipe social fintech di Indonesia serta merumuskan 20 (dua puluh) usulan strategi pengembangan social fintech untuk mencapai Sustainable Development Goals di Indonesia yang komprehensif. Secara kuantitatif, diperoleh 7 (tujuh) usulan strategi yang menjadi prioritas yaitu: (1) Kerja sama antara lembaga non Institusi Jasa Keuangan (donatur) dengan Social Fintech; (2) Menyusun model strategi bisnis berpola demand and supply dalam perspektif Social Fintech; (3) Pemberdayaan komunitas masyarakat produktif (literasi dan inklusi keuangan); (4) Pengembangan paradigma baru social impact & implementasi sustainable development goals secara konsisten oleh Industri Jasa Keuangan; (5) Channeling dan network komunitas/across group terkait penyaluran dana; (6) Fasilitas Capacity Building dan Skills Training dalam konteks pengembangan model bisnis; serta (7) Model kolaborasi dengan perusahaan penyedia jaringan telekomunikasi (internet).

Researcher: Wimboh Santoso, Sukarela Batunanggar, Irwan Trinugroho, Djoko Suhardjanto, Suryanto

(*) Currently this research paper only available in Bahasa Indonesia

Penelitian ini secara komprehensif akan mengkaji terkait dengan transformasi digital di industri perbankan di Indonesia. Studi akan dilakukan secara kualitatif dengan pertama, melakukan environmental scanning faktor eksternal dan internal di dalam industri perbankan saat ini baik dalam konteks domestik maupun global. Kedua, mengkaji mengenai tingkat kesadaran (awareness), tingkat kesiapan (readiness) dan tingkat kemajuan (level of advance) dari inovasi keuangan berbasis teknologi yang dilakukan oleh industri perbankan di Indonesia baik dilihat dari sudut pandang bank maupun dari sisi nasabah. Lebih lanjut, studi ini juga akan mengkaji mengenai dampak dari keberadaan fintech terhadap industri perbankan. Kemudian, akan dilakukan pula benchmarking terkait dengan penerapan digital banking dengan industri perbankan di negara lain baik di negara-negara berkembang maupun di negara-negara maju. Terakhir, studi ini akan memberikan rekomendasi kebijakan terkait dengan strategi dan langkah-langkah yang tepat dalam rangka transformasi digital di industri perbankan Indonesia. Studi ini akan dilakukan melalui beberapa metode yaitu in-depth interview dengan top manajemen di beberapa bank di Indonesia, survei kepada beberapa pimpinan kantor cabang bank di daerah, survei kepada nasabah perbankan, benchmarking melalui analisis data archival, dan focus group discussion dengan otoritas perbankan. Studi ini dilakukan melalui metode yaitu in-depth interview dengan 50 top manajemen di 20 bank di Indonesia dan survei kepada 357 responden individu.

Researcher Wimboh Santoso, Sukarela Batunanggar, Tulus Tahi Hamonangan Tambunan, Ida Busneti, Dian Octaviani

The aim of this research is to examine recent development of micro, small and medium enterprises (MSMEs), their main constraints and access to financing, and the growth of online-based Peer-to-Peer (P2P) lending in Indonesia. This is a descriptive study which analyses secondary and primary data. Primary data were collected from: (i) a survey of 60 respondents, i.e. 30 owners of MSMEs and 30 managers/directors of P2P lending companies, of which a total of 40 were deemed usable (i.e. 10 MSMEs and 30 P2P), and (ii) a series of focus group discussions (FGD) with some of the selected P2P companies. This study’s results show the number of MSMEs continue to grow even though they face a number of obstacles with limited access to funding as the most serious. Although commercial banks are required by the government to extend credit to MSMEs, the percentage of total commercial credit to these enterprises is still very small. Therefore, as the survey’s finding suggested, the emergence of P2P is important as an alternative source of funding for MSEs. and bank is the main investor in P2P lending companies. To the authors' knowledge, this is the first study ever done, at least in Indonesia. It takes stock of the empirical evidence in the literature through the lens of MSMEs’ owners.

| Paper Published in: International Journal of Innovation, Creativity and Change. www.ijicc.net Vol. 15, Issue 2, 2021. |

Researchers: Wimboh Santoso, Sukarela Batunanggar, Palti Marulitua Sitorus, Farida Titik Kristanti, Andry Alamsyah, Grisna Anggadwita

Purpose

The development of information technology is highly influential to all sectors, including the financial industry. Various transformations are made in overcoming the dynamics of technological advancements, including the mapping of human resources. This study is conducted in the banking industry and companies operating using financial technology (FinTech) in Indonesia. This study aims to identify talent competencies needed in the future, based on current conditions and future needs, through mapping talent in the banking and FinTech industries.

Design/methodology/approach

This study provides empirical evidence about the mapping of talent management with eight basic competencies. It uses a mixed-method, explanatory sequential with survey approach in the first phase and focus group discussions (FGD) in the second phase. The questionnaire is distributed to 309 respondents who are the specific decision-makers in this industry. Meanwhile, the FGD is conducted twice at different times with academics and practitioners, human resources and talent managers. This research used analytic hierarchy process as a tool for data processing.

Findings

This study provides current competency positions and future needs in the banking and FinTech industries in Indonesia where it found a lot of competence segregation. It also discovered three priority competencies for dealing with Industry 4.0, which included relating and networking, adapting and responding to change and entrepreneurship and commercial thinking.

Practical implications

This study is valuable for decision-makers and regulators; these results can be used to find new competencies and talents to develop existing human resources. Also, these results can be used as a basis for policy-making related to the Industrial Revolution 4.0.

Originality/value

This study provides new insights on talent mapping in the banking and FinTech industries as a strategic approach in the digitalization era. In addition, this research also adds knowledge related to Industry 4.0 as a result of industry developments in the digitalization era.

| Paper published in: Journal of Science and Technology Policy Management, Vol. 12, Issue 3, 2021 |